One of the most frequently asked questions I encounter is,

“What is the best way to manage rental or investment properties and effectively handle the associated income and expenses?”

The truth is, the answer varies widely. It depends on several key factors, including the size of your real estate portfolio, the number of LLCs you operate, and whether you choose to manage your properties independently or work with a property management company.

In this article, we will explore various strategies for optimizing your flow of income and expenses related to real estate investments. For the purpose of our discussion, we will assume you are utilizing a holding company, specifically an Asset Management Limited Partnership (AMLP).

Lets fist dive into some different management options available based on diverse circumstances and needs. Then I will breakdown various examples of situations:

Understanding Your Real Estate Management Options

When it comes to asset protection and real estate management, it’s essential to consider the following factors:

1. Portfolio Size: The number of properties you own can significantly influence your management strategy. A larger portfolio may necessitate a more complex structure, whereas a smaller scale may allow for simpler solutions.

2. Entity Structure: The formation of multiple LLCs or other legal entities plays a crucial role in protecting your assets and managing liability. Understanding how these entities work together can enhance your asset protection strategy.

3. Management Approach: Deciding whether to self-manage your properties or enlist a property management company will impact operational efficiency, tenant relations, and your overall investment experience.

Establishing a Streamlined Income and Expense Flow

A well-organized system for tracking and managing income and expenses is vital for any real estate investor. Here are some best practices to consider:

– Utilize Technology: Leverage property management software to streamline the tracking of rental income and expenses. This will not only save time but also provide valuable insights into your investment performance.

– Consistent Record-Keeping: Maintain organized financial records and receipts related to all income and expenditure. This practice is essential for tax purposes and ensures you have a clear understanding of your financial position.

– Plan for Taxes: Work with a tax professional who specializes in real estate to better understand the implications of your income and expense management strategies. Proper planning can lead to significant tax savings.

– Reassess Regularly: The real estate market is constantly evolving. Regularly review your management strategies and adjust them as necessary to optimize performance.

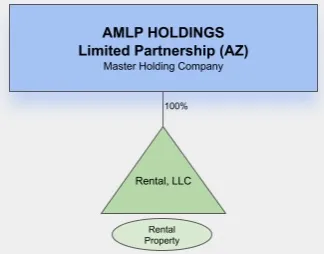

SITUATION 1 (Holding Company with One LLC)

In this straightforward scenario, we have a holding company and a single LLC designated to manage the rental or investment property. The management options here are quite clear:

Option 1: Managing the Property through the LLC

In this approach, you would establish a dedicated bank account in the name of the LLC to handle all rental income and associated expenses. The LLC will need to apply for and obtain an Employer Identification Number (EIN) from the IRS. Importantly, since it’s a single-member LLC, it won’t be required to file a separate tax return; instead, all income and expenses will be reported on the Asset Management Limited Partnership (AMLP) 1065 Partnership Tax Return.

Option 2: Managing the Property through the AMLP

Alternatively, you could designate the AMLP as the “Manager” of the property, processing all income and expenses directly through the AMLP.

Best Practice: In this case, the recommended approach is Option 1. This keeps the holding company insulated from direct interactions with tenants or vendors and effectively isolates the LLC’s operational activities. While this may require managing an additional bank account and obtaining an EIN, it does not impose the need for a separate tax return. Furthermore, maintaining a separate bank account for the LLC is generally a prudent practice for organized financial management.

**Note**: Although using the AMLP to manage underlying assets is permissible, I typically advise against this from an asset protection perspective. It’s best to avoid having the AMLP engage directly with tenants or vendors, so in subsequent examples, I will not include this option.

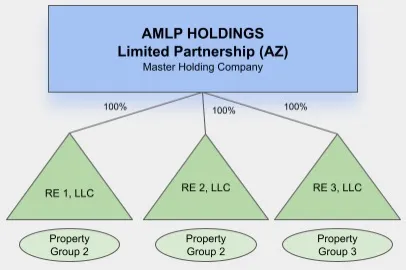

SITUATION 2 (Holding Company with Multiple LLC)

In this scenario, we slightly complicate the structure with additional LLCs. This creates additional options for managing the flow of income and expenses.

OPTION 1: Choose one of the LLCs to pull ‘double duty‘ and serve to both hold RE and manage all the property. This would involve setting up a bank account in the name of the one LLC and collecting the rents and the expenses through that one account for all of the other LLCs. That one LLC will need to apply for and receive and EIN from the IRS. The other LLCs will not need an EIN at all. None of the LLCs will file a separate tax return as they are all single member LLC and all tax accounting will be done on the AMLP 1065 Partnership Tax Return.

OPTION 2: Have each LLC manage its own income and expenses directly. This would involve setting up a separate bank account for each LLC. This also means applying for an EIN for each LLC. Each LLC will keep its own set of books and records but they will still not be required to file separate tax returns and all accounting will be done on the AMLP return.

OPTION 3: Set up a separate LLC to be used only for managing property. This becomes a good idea when you begin to have many LLCs or are a real estate professional and your primary activity is real estate.

BEST PRACTICE: In this scenario, with only 3 LLCs, the best practice is Option 1. Option 1 keeps the banking simple and as long as you set up your accounting software correctly it will still be easy to track the income and expenses of each property. Option 2, is also an acceptable choice for those who prefer separating everything. If that works better for you, then Option 2 is fine and just means more bank accounts, checkbooks and statements.

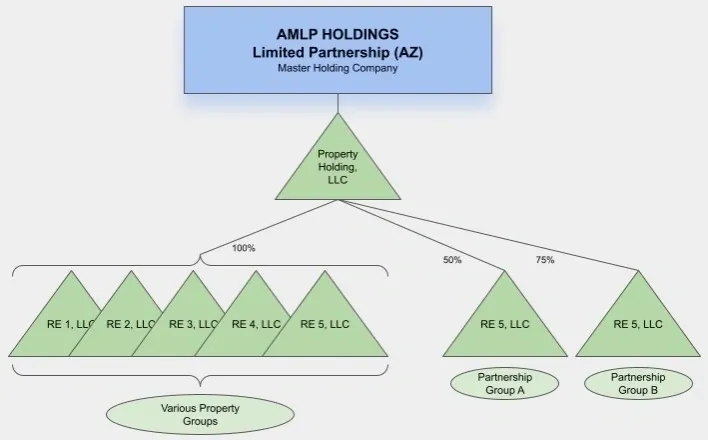

SITUATION 3 (Holding Company with Multiple Single and Multi Member LLCs)

In this scenario, we have significant complication with many (5 or more) single member LLCs and two or more multiple member LLCs for RE investments with partners. The options here become more complicated.

OPTION 1: Choose one of the LLCs to pull ‘double duty‘ and serve to both hold RE and manage all the property. This is likely no longer a good option, especially when there are multiple member LLCs which involve partners.

OPTION 2: Have each LLC manage its own income and expenses directly. For the multiple member LLCs this is basically required. These should have their own bank accounts and will be required to file a separate 1065 partnership tax return. Since there are multiple partners, keeping separate accounts and books is critical. This could also be done for your single member LLCs; however, it will begin to get very complicated with many bank accounts.

OPTION 3: Set up a separate LLC to be used only for managing property. At this point, this is a good idea. This allows for clarity within your own properties, but also with the the Multi-member LLCs in which you have partners. The property management LLC can be directly owned by the AMLP, or if your CPA prefers that you tax this as an S-Corp it would be owned by you personally.

BEST PRACTICE: In this scenario, with many single and multi-member LLCs, the best practice is a combination of Options 2 and 3. Option 2 will be required for the multi-member LLCs and keeps the banking and accounting separate. Option 3, using the property management LLC, is now a good idea and worth the extra expense. Additionally, you have the option of taxing it as an S-Corp which may be advantageous from your CPAs standpoint. Definitely worth consulting with you CPA before choosing.

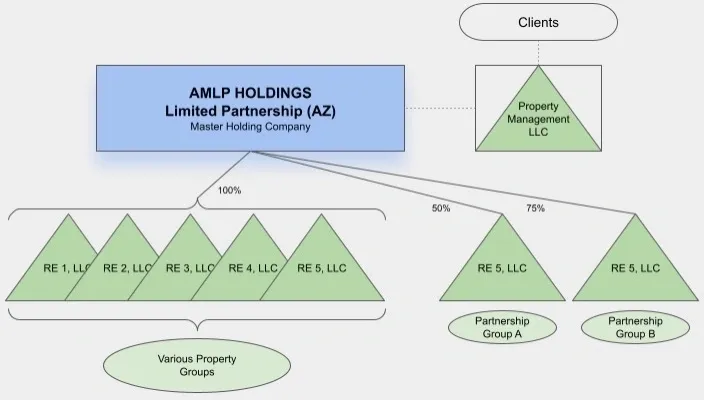

SITUATION 4 (Holding Company with RE Holding Company and Multiple Single and Multi Member LLC)

This is actually a variation of Situation 3 above. In this case, we have a specific RE Holding Company under the AMLP. This can be used when a client wants to have a layer of privacy, the ‘Property Holding LLC‘ can be set up in WY. In this case that company can also serve as the management company as discussed above.

This structure is slightly more cumbersome than having the underlying LLCs directly held by the LLC, but is equally as protective. This is often used for clients who do already have a RE holding company established and are adding the AMLP and Bridge Trust.

There are considerations beyond the scope of this article and if you have any questions about your specific structure, please contact me directly at (888) 773-9399.

By: Brian T. Bradley, Esq.