Introduction: Understanding Asset Protection Structures

When it comes to asset protection planning, many individuals—including professionals such as attorneys, CPAs, business owners, and real estate investors—ask:

“What is the difference between an Asset Management Limited Partnership (AMLP) and a Limited Liability Company (LLC)?”

Both AMLPs and LLCs offer liability protection and tax advantages, but their effectiveness varies based on structure, control, and their ability to protect assets from lawsuits, creditors, and unforeseen liabilities.

This guide follows Mark and Sarah, a high-net-worth couple navigating asset protection planning for their financial legacy. Their journey will help you determine whether an LLC or an AMLP best suits your asset protection goals.

Mark and Sarah’s Asset Protection Journey

Mark, a successful surgeon, and Sarah, a real estate developer, realized they needed a solid legal structure to protect their assets. With Mark’s exposure to medical malpractice lawsuits and Sarah’s high-risk real estate investments, they were concerned about potential creditor claims and litigation threats.

“We need something that protects everything we’ve built,” Sarah said.

Mark agreed. “But should we form an LLC or an Asset Management Limited Partnership (AMLP)?”

They reached out to a leading asset protection attorney for guidance.

What Is an Asset Management Limited Partnership (AMLP)?

An Asset Management Limited Partnership (AMLP) is a powerful asset protection structure used for over a century by investors, business owners, and high-net-worth individuals. It is a preferred tool for estate planning, business structuring, and shielding assets from lawsuits.

AMLP Structure:

• General Partner(s): Retains full management control and responsibility for the partnership’s liabilities.

• Limited Partner(s): Has no control over partnership assets and is only liable for their initial investment.

This structure makes AMLPs ideal for families, estate planning, and business investments, where some members want control while others prefer passive investment roles. Family Limited Partnerships (FLPs) are a common AMLP structure used to preserve generational wealth.

Taxation of an AMLP

AMLPs have a unique tax structure:

• They must file a 1065 partnership tax return.

• The AMLP’s income passes through to the partners, recorded on a K-1 form, avoiding double taxation.

This pass-through taxation allows partners to report income on their individual tax returns, simplifying the tax process.

To learn more about the power of Limited Partnerships, click this link:

Key Asset Protection Benefit: Charging Order Protection

Mark was particularly intrigued when he learned that in states like Arizona and Nevada, creditors are limited to a charging order as their exclusive legal remedy.

Legal Authority: A.R.S. § 29-3503

• Arizona law states that a charging order is the sole remedy against a partner’s interest.

• This was upheld in NextGear Capital, Inc. v. Owens (2023), confirming that creditors cannot seize partnership assets or force a sale.

A charging order allows creditors to place a lien on a partner’s potential distributions without granting control over assets. This means creditors may wait indefinitely without receiving payouts—sometimes even incurring tax liabilities without income.

Sarah’s reaction:

“That exclusive charging order sounds like a nightmare for creditors. No wonder high-net-worth families use AMLPs for asset protection.”

What Is a Limited Liability Company (LLC)?

The Limited Liability Company (LLC) is a modern legal entity, first recognized in Wyoming and Florida in the 1970s, designed to combine:

✔ Limited liability (like a corporation)

✔ Pass-through taxation (like a partnership)

Before LLCs, businesses relied on S-Corporations (S-Corps), which had strict ownership restrictions. The LLC revolutionized business structures by eliminating these restrictions while offering robust liability protection.

LLC Structure:

• Members: Owners of the LLC (can be individuals, trusts, or businesses).

• Management: Typically majority-rule (51%) decision-making, but customizable through Operating Agreements.

Key Differences: AMLPs vs. LLCs for Asset Protection

Mark and Sarah wanted to compare AMLPs and LLCs for asset protection planning. Here’s what they discovered:

1. Dissolution Requirements

✔ LLC: Can be dissolved by a 51% majority vote of members.

✔ AMLP: Requires unanimous consent of all partners, making it far harder for creditors or lawsuits to force a liquidation.

Mark’s reaction:

“So, if someone sues me and gets control of part of an LLC, they could force dissolution more easily than an AMLP?”

The attorney nodded.

“Exactly. AMLPs provide more structural integrity against legal attacks.”

2. Administrative Vulnerabilities

LLCs Can Face Automatic Dissolution If:

• Owners fail to update articles of organization.

• The state is not notified of a registered agent change.

• The LLC lacks a registered office for 60+ days.

In contrast, AMLPs have fewer regulatory burdens, making them more resilient in asset protection.

3. Creditor Protection from Distributions

✔ LLC: Members may be forced to make distributions.

✔ AMLP: No mandatory distributions until the winding-up phase.

Sarah’s takeaway:

“An LLC exposes funds to creditors, while an AMLP lets us control distributions and keep assets locked away.”

Why AMLPs Are Preferred for Asset Protection

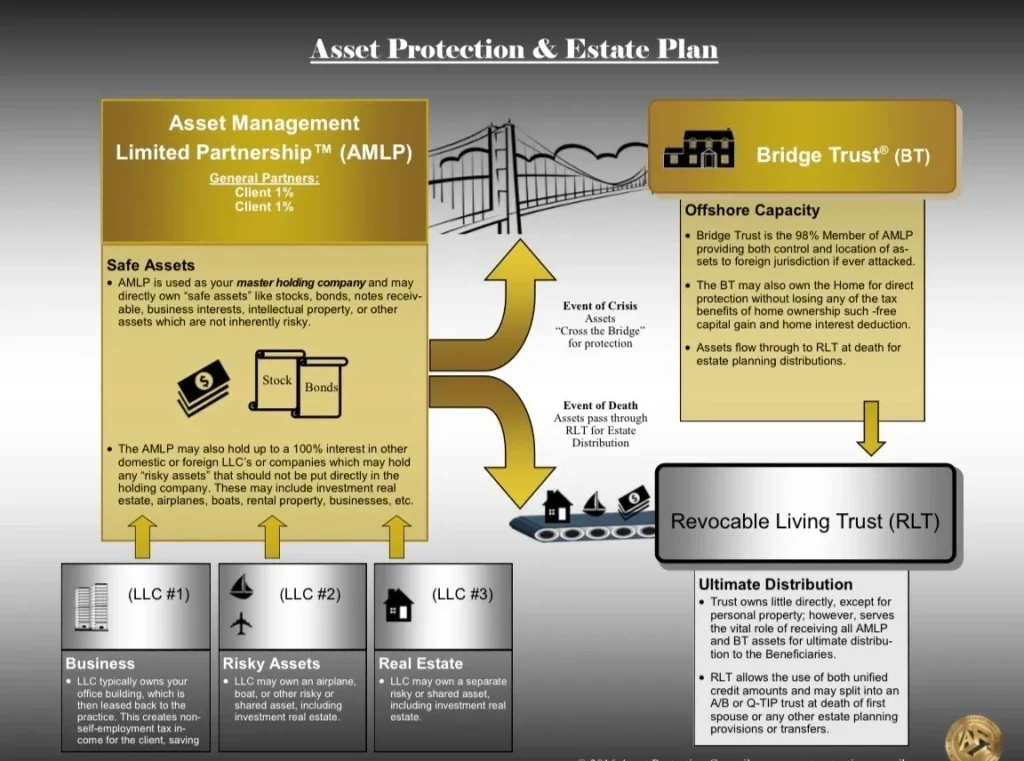

Given these structural advantages, Mark and Sarah’s attorney recommended an AMLP with a Bridge Trust® as the ultimate asset protection structure.

How This Strategy Works:

✔ Mark & Sarah become minority general partners, retaining control.

✔ A Bridge Trust® becomes the majority limited partner, owning assets without direct control.

✔ LLCs under the AMLP hold high-risk assets like real estate and boats.

When to Use an LLC Instead

While AMLPs are superior for holding protected assets, LLCs are still essential for riskier assets, including:

• Rental properties

• Watercraft & aircraft

• Investment properties

By structuring LLCs under the AMLP, Mark and Sarah shielded their real estate investments while keeping their financial assets safe in the AMLP.

Conclusion: Building a Comprehensive Asset Protection Plan

Mark and Sarah implemented their attorney’s asset protection plan, ensuring:

✔ Their AMLP held their financial assets, overseen by a Bridge Trust®.

✔ Their LLCs protected their high-risk assets under the AMLP.

They left with peace of mind, knowing their wealth was secure.

Key Takeaways:

✔ AMLPs provide superior legal protection with stronger dissolution safeguards.

✔ LLCs offer flexibility but are weaker against creditor claims.

✔ Using both AMLPs & LLCs under a Bridge Trust® creates maximum protection.