Why Limited Partnerships (LPs) Outperform LLCs in Asset Protection

When building a robust asset protection strategy, the choice of a management company is critical. Limited Partnerships (LPs) offer significant advantages over Limited Liability Companies (LLCs) in this role. Let’s explore why LPs excel and how they enhance your financial success.

What is an LP and Why Is It Better Than an LLC?

An LP (Limited Partnership) is a business structure with two distinct classes of ownership:

• General Partner (GP): The GP manages operations and holds controlling interest.

• Limited Partner (LP): The LP holds ownership interest but has no management authority, providing liability protection.

This dual ownership structure creates a clear separation of control and ownership, which is a major advantage over LLCs.

Key Benefits of LPs Over LLCs

1. Dual ownership structure eliminates potential fraudulent conveyance arguments in court.

2. Offers superior tax advantages with full income recognition for lending and deductions through guaranteed payments.

3. Enhances asset protection by separating management (General Partner) from ownership (Limited Partner).

4. Exclusive Charging Order Protection. Click this link to read about the asset protection strength of LPs vs LLCs.

Advantages of LPs Over LLCs for Asset Protection

1. Dual Ownership Structure

An LP has a split ownership model:

• The General Partner (Control): This is typically you, giving you control over your assets.

• The Limited Partner (Ownership): Often structured as an Asset Protection Trust, holding the ownership interest securely.

Example:

• Think of the General Partner as the “left brain” (logic and control) and the Limited Partner as the “right brain” (ownership and protection).

• LLCs lack this separation, increasing legal risks.

2. Full Income Recognition for Lending

LPs ensure 100% income recognition on tax returns for loan underwriting, unlike LLCs where only 75% of income is considered.

Example:

• Scenario: You’re a real estate investor with $100,000 in passive income.

• LLC: Only $75,000 is considered for lending.

• LP: The full $100,000 is recognized, maximizing your borrowing potential.

3. Enhanced Tax Benefits with LPs

Using an LP, especially in combination with a C-Corp as a management company, offers several tax advantages:

• Guaranteed payments to partners are deductible against the partnership’s income.

• Management companies (e.g., C-Corps) can benefit from the flat 21% corporate tax rate.

Example:

• Scenario: A stock investor uses an LP to hold brokerage accounts, with a C-Corp managing the account.

• This structure allows for deductible expenses and optimized tax liability.

4. Superior Asset Protection

LPs inherently limit liability for limited partners and provide better protection for assets in a layered system.

Example:

• Scenario: Your LP owns rental properties through LLCs. If one LLC faces a lawsuit, the LP’s other assets remain shielded due to the separation of roles.

How to Use LPs for Real Estate, Stocks, and Legacy Planning

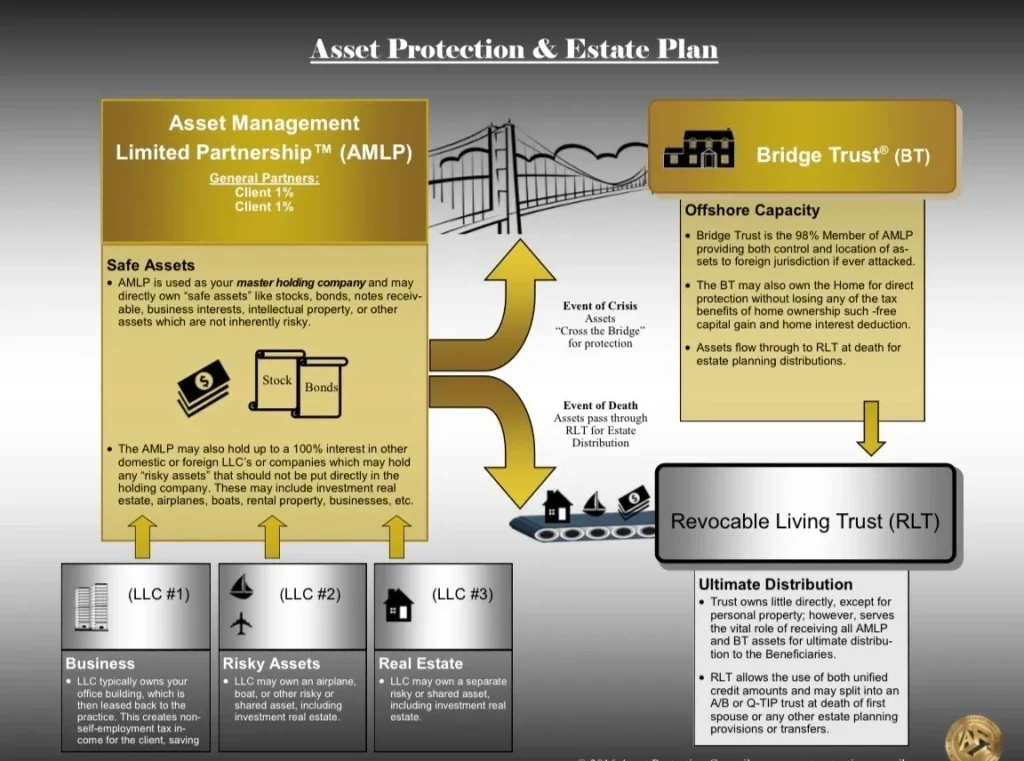

1. LP as the Asset Management Hub

Set up an Asset Management Limited Partnership (AMLP) as the central entity. This LP can:

• Hold investments like cash, stocks, bonds, syndication shares, or businesses.

• Use LLCs under its umbrella for specific risky asset holdings like real estate.

2. Adding a Management Company

Use a C-Corp or LLC taxed as a C-Corp to manage the LP.

• This creates a two-entity system:

• LP for asset holding.

• C-Corp for management services.

Example:

• The LP holds brokerage accounts.

• The C-Corp manages accounts, benefiting from the 21% flat corporate tax rate.

Common Use Cases for LPs

1. Real Estate Investors

• Challenge: Maximize borrowing capacity and tax efficiency.

• Solution: Use an LP for full income recognition and a C-Corp manager for streamlined operations.

2. Stock Market Investors

• Challenge: Reduce taxes on brokerage accounts.

• Solution: Combine an LP with a C-Corp manager for tax deductions and liability protection.

3. Family Legacy Planning

• Challenge: Ensure continuity and minimize estate taxes.

• Solution: Use an LP to hold assets, ensuring step-up in basis and streamlined succession.

Key Steps to Implement an LP System

1. Engage Professionals: Work with your CPA and asset protection attorney to design the structure.

2. Focus on Compliance: Ensure proper reporting to avoid tax and regulatory issues.

3. Customize the System: Tailor your LP and management company to meet your specific financial goals.

Why Limited Partnerships (LPs) Are the Superior Choice

Limited Partnerships offer unmatched advantages for asset protection and financial efficiency:

• Dual ownership for separation of control and ownership.

• Full income recognition for lending.

• Enhanced tax benefits through guaranteed payments and management entities.

• Superior asset protection in layered systems.

• Exclusive charging order protection. A.R.S. § 29-3503

Take control of your financial future by leveraging LPs for your asset protection strategy.

FAQ

• What is the main difference between an LP and LLC?

LPs have dual ownership classes (General and Limited Partners), while LLCs don’t.

• How does an LP help with taxes?

LPs offer full income recognition for loans and allow deductible guaranteed payments to partners.

• Why should I use an LP for asset protection?

LPs provide a clear separation of control and ownership, reducing legal risks and enhancing protection.

Let Bradley Legal Corp. assist you in achieving that peace of mind.

Call to schedule a legal consultation with an asset protection lawyer at (888) 773-9399

By: Brian T .Bradley, Esq.