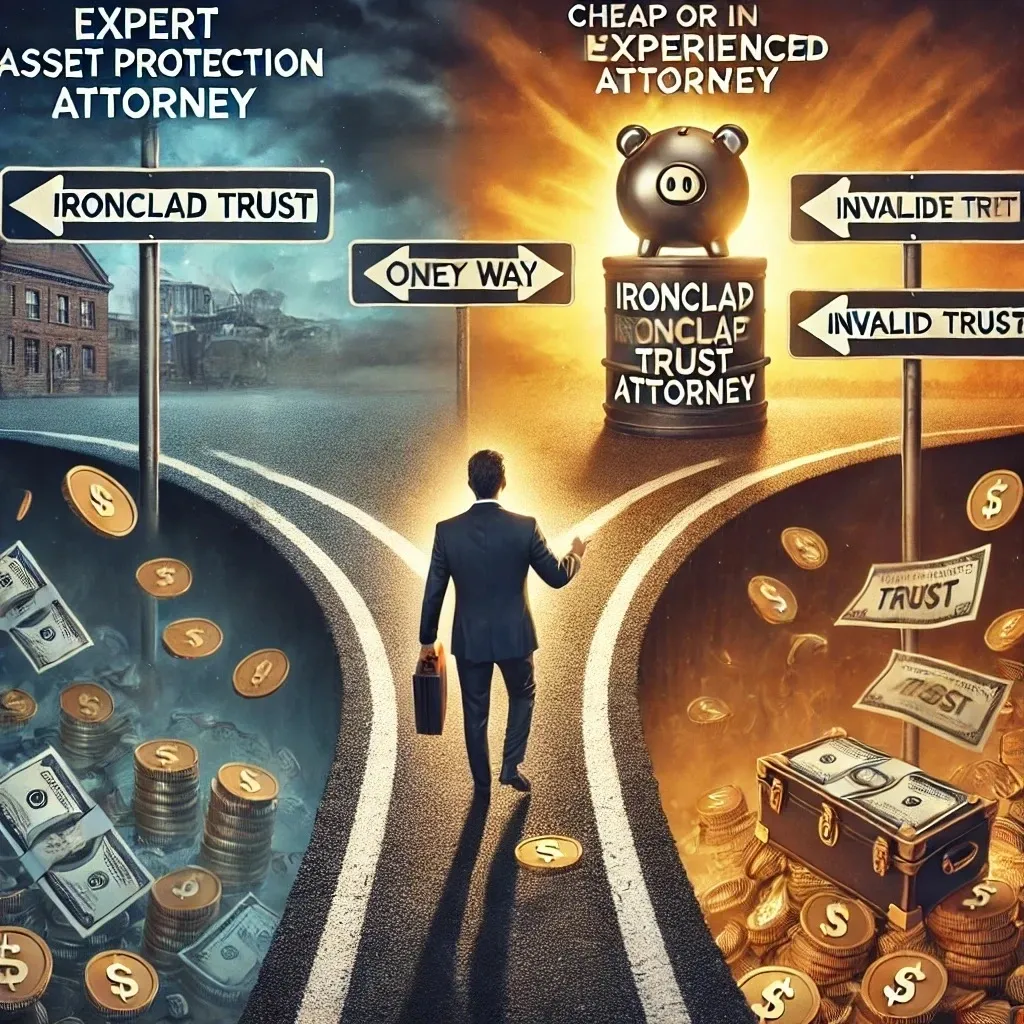

A Costly Mistake or a Secure Future?

Imagine this: Michael, a successful business owner, spent 30 years building his wealth. Real estate investments, a thriving company, and millions in liquid assets—everything was going well. But then, a lawsuit blindsided him. He thought his assets were safe in a basic trust he got online for $500, only to find out that it was full of loopholes.

His worst nightmare? The court ordered his assets liquidated to pay the judgment.

What went wrong? He cut corners on asset protection.

Now, ask yourself: Is the cost of setting up an irrevocable trust more important than the cost of losing everything?

If you’re serious about protecting your wealth, you need to understand the true cost of a trust, the value behind a proper asset protection plan, and why going cheap can be the most expensive mistake you ever make.

How Much Does It Cost to Set Up an Irrevocable Trust?

The cost of setting up an irrevocable trust varies significantly based on complexity, jurisdiction, and attorney expertise.

Domestic Irrevocable Trusts

A U.S.-based irrevocable trust typically costs between $3,000 and $6,000 for a properly structured estate planning trust. However, advanced asset protection trusts designed to shield wealth from lawsuits, creditors, and judgments start at $15,000 and can go up to $35,000 or more, depending on complexity.

Could you find a lawyer advertising a $1,500 irrevocable trust? Sure. But ask yourself:

• Are they experts in asset protection, or do they just draft estate planning trusts?

• Will that trust actually stand up in court when challenged?

• Do they offer ongoing legal guidance to ensure your trust remains effective?

Offshore Irrevocable Trusts (Maximum Asset Protection)

For those who want ironclad protection, offshore trusts—such as those in the Cook Islands or Nevis—offer the highest level of security. These trusts operate outside U.S. jurisdiction, making it nearly impossible for domestic creditors to seize assets.

However, offshore trusts come at a higher cost:

• Setup Fees: $25,000–$50,000

• Annual Maintenance & Compliance: $10,000–$12,000 per year

Why the added cost? Offshore trusts require:

✅ Expert structuring to comply with international laws

✅ Legal trustee services in a foreign jurisdiction

✅ Banking and administrative setup fees

✅ Advanced legal strategies that standard estate planning trusts do not cover

Now, consider this: If you have millions of dollars in assets, does it make sense to “save” $10,000 on a trust, only to lose millions to a lawsuit?

What Happens If You Hire the Wrong Attorney?

Let’s be clear—not all attorneys are created equal. Just like you wouldn’t hire a general doctor to perform brain surgery, you shouldn’t hire a general estate planning attorney to draft your asset protection trust.

Many attorneys advertise trust drafting services but lack deep knowledge of asset protection law. Others sell cheap trusts without truly understanding how to make them bulletproof against lawsuits, creditor claims, and legal challenges.

The False Sense of Security Trap

When you hire the wrong attorney, you’re not actually protecting your wealth—you’re just buying a false sense of security. Here’s what happens:

🔹 Your trust isn’t structured correctly – Courts can easily “pierce” weak trusts, meaning your assets are still at risk.

🔹 The trust has loopholes – A properly structured asset protection trust must comply with state and international laws to be effective. If your attorney misses key details, creditors will find a way in.

🔹 The attorney lacks litigation experience – Asset protection is not just about drafting documents; it’s about structuring legal strategies that will hold up in court when challenged. Many attorneys have never defended a trust in litigation—which means they don’t know how to make it court-proof in the first place.

🔹 You’re vulnerable to fraudulent transfer claims – If your trust is not structured properly, a creditor can argue fraudulent transfer and the court can undo the trust entirely, leaving you exposed.

Would You Risk Your Entire Fortune to Save a Few Thousand Dollars?

Ask yourself this:

1️⃣ Would you trust a discount surgeon to operate on your brain?

2️⃣ Would you hire the cheapest security company to protect a multimillion-dollar estate?

3️⃣ Why would you cut corners on the one thing that ensures your wealth stays protected?

When it comes to asset protection trusts, getting it done right is far more important than getting it done cheap.

The Real Cost of Going Cheap on a Trust

Let’s say you decide to cut corners and buy a cheap trust online for $500-$1,500. What happens when someone sues you?

Here’s what they’ll do:

🔍 They’ll investigate how your trust was structured. If they find flaws (and they will), they’ll convince the court to invalidate the trust—meaning your assets are no longer protected.

⚖️ They’ll argue fraudulent conveyance. If you transferred assets incorrectly, the court can reverse those transfers and order assets handed over to the plaintiff.

💰 They’ll go after your trustee. If your trust is not managed by an independent, professional trustee, the court can force them to comply with legal demands.

And just like that—your “low-cost” trust is worthless.

Why The Right Trust is Worth Every Penny

A properly structured irrevocable trust provides:

✅ Asset Protection: Shields wealth from lawsuits, creditors, and judgments

✅ Estate Planning Benefits: Ensures your wealth goes to your heirs and not the government

✅ Tax Advantages: Potential deferral or reduction of estate taxes in certain trust structures

✅ Long-Term Security: Ensures no one can access your wealth except those you choose

A cheap trust? It does none of this.

Final Thought: Your Wealth, Your Choice

Michael learned the hard way that going cheap on asset protection was a $10 million mistake.

So, ask yourself:

• Do you want to take that risk?

• Would you rather invest in proven, expert protection or gamble with your financial future?

• What’s more expensive—paying for proper protection now, or losing your assets later?

At Bradley Legal Corp., we don’t do cookie-cutter trusts. We do bulletproof asset protection.

If you’re serious about keeping your wealth safe, let’s build a trust that actually works.

📞 Schedule a consultation today and secure your financial future. (888) 773-9399.

By: Brian T. Bradley, Esq.