The Dangerous Assumption That Could Cost You Everything

Many high-net-worth individuals assume that their CPA and estate planning attorney have them fully covered when it comes to financial protection.

After all, they handle your taxes, trusts, and business structure, so they must be making sure your wealth is protected from lawsuits and creditors, right?

Wrong.

Your CPA and estate planning attorney are not asset protection experts. Relying on them for lawsuit protection and creditor defense could leave you completely exposed.

In this guide, we’ll break down:

✅ Why CPAs cannot provide legal asset protection strategies

✅ Why estate planning attorneys only protect assets after death, not while you’re alive

✅ The biggest tax planning mistakes that lead to asset vulnerability

✅ What a true asset protection plan should include

🚨 Related Resource: Want to make sure you’re working with the right expert? Read our guide on How to Pick an Asset Protection Attorney.

1. Your CPA’s Job Is Tax Efficiency—Not Lawsuit Protection

What CPAs Do Well

🔹 Tax optimization – Reducing taxable income through deductions and credits

🔹 IRS compliance – Ensuring business entities and structures follow tax laws

🔹 Strategic business structuring – Helping minimize self-employment taxes

Where CPAs Fail at Asset Protection

🚫 CPAs Are Not Attorneys

• CPAs cannot draft legal documents or provide legal protection against lawsuits.

• Many CPAs unknowingly give bad legal advice on business structures, exposing clients to lawsuits.

🚫 Tax Savings Do Not Equal Asset Protection

• A CPA may structure an LLC or S-Corp for tax benefits, but if it’s not designed for lawsuit defense, it’s worthless in court.

• Asset protection trusts and offshore entities are lawsuit shields—not tax loopholes.

🚫 CPAs Focus on Tax Audits, Not Lawsuits

• A CPA is trained to minimize IRS exposure, but they do not structure entities to protect against lawsuit judgments, business liabilities, or creditor attacks.

2. Common CPA Mistakes That Expose You to Lawsuits

Mistake #1: Relying on LLCs for Protection

❌ CPAs often recommend LLCs as a tax-efficient structure.

❌ The problem? LLCs can be easily pierced in lawsuits if not set up correctly.

❌ If a court deems an LLC a tax-motivated entity, it may be ignored for asset protection purposes.

🔹 Example:

A real estate investor holds multiple rental properties in a single LLC based on CPA advice. When a tenant sues, all properties are exposed because they are in one lawsuit-vulnerable entity.

✅ Solution:

• Use separate LLCs for each high-risk property.

• Implement an asset protection trust to create a firewall against lawsuits.

Mistake #2: Using Revocable Trusts for “Protection”

❌ Revocable living trusts do not protect assets from lawsuits.

❌ Since the grantor retains control, courts can force trust assets to be used for judgments.

🔹 Example:

A doctor has an estate plan with a revocable trust. When sued for malpractice, the court orders assets in the trust to be liquidated, since the trust provides no legal separation.

✅ Solution:

• Use an irrevocable trust for bulletproof asset protection.

• Implement offshore asset protection trusts for the highest level of defense.

Mistake #3: Holding Assets in an S-Corp or C-Corp for “Protection”

Many CPAs wrongly advise clients to hold business assets inside an S-Corp or C-Corp for tax benefits—but this is a huge asset protection mistake.

🚫 Why an S-Corp is a Lawsuit Disaster

1️⃣ S-Corps Have No Charging Order Protection

• Unlike LLCs, creditors can seize S-Corp shares in a lawsuit.

• Losing a lawsuit can result in forced corporate asset liquidation.

2️⃣ Strict Ownership Rules Make Transfers Impossible

• S-Corp stock cannot be freely transferred without triggering a dissolution.

• If you are sued, a creditor can take your shares and force a corporate sale.

3️⃣ Holding Real Estate in an S-Corp is a Legal Disaster

• The IRS prohibits tax-free property transfers in and out of an S-Corp.

• A single lawsuit puts all real estate holdings in jeopardy.

✅ Solution:

• Never hold real estate in an S-Corp—use an LLC in the state the asset is located in instead.

• Use separate entities for tax benefits and legal protection—they should never be combined.

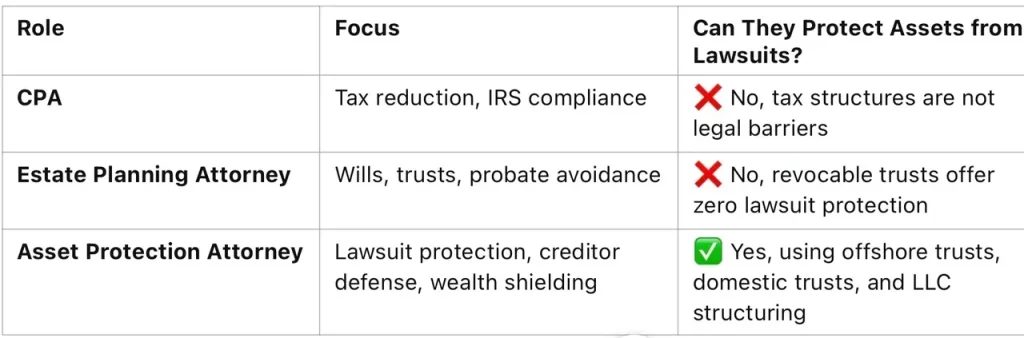

3. The Key Differences Between CPAs, Estate Attorneys, and Asset Protection Attorneys

🚨 Bottom line: CPAs and estate attorneys focus on taxes and inheritance, not asset protection.

📖 Read More: Many people misunderstand asset protection. Learn the truth in our article 14 Common Myths About Asset Protection. https://btblegal.com/blog-articles/f/myth-busting-asset-protection-14-common-misconceptions-explained

4. Why Asset Protection Attorneys Charge Consultation Fees

Some people hesitate when they see a consultation fee, but legal expertise—especially in a specialized area like asset protection—is not free advice. Experienced attorneys charge for consultations because:

✅ You’re paying for real legal strategy, not a sales pitch – A consultation with an asset protection attorney isn’t just a quick chat; it’s an in-depth analysis of your financial risk, business structure, and exposure to lawsuits.

✅ Asset protection is complex and highly specialized – Unlike general estate planning, asset protection requires advanced legal structuring, knowledge of domestic and offshore trust law, and experience dealing with real-world legal threats.

✅ There is no “one-size-fits-all” solution – Every client’s situation is unique, and crafting the right strategy requires a detailed, professional evaluation—not generic advice.

✅ Serious clients, serious solutions – Paying for a consultation ensures that time is spent on clients who genuinely need asset protection, not just seeking free information.

Most attorneys in specialized fields—whether estate planning, divorce, or criminal defense—charge for their time and expertise. Asset protection is no different. If protecting your wealth is important, investing in expert legal guidance is a small price to pay compared to the financial risk of going unprotected.

📖 Read More: Learn how to pick the right asset protection attorney. https://btblegal.com/blog-articles/f/how-to-choose-the-right-asset-protection-lawyer

5. What You Should Do Next

🚨 If you’re relying on a CPA or estate attorney for asset protection, you are at risk.

📞 Get a real asset protection plan today. 🔹 Call (888) 773-9399

Final Thoughts: Why You Need a True Asset Protection Plan

Many CPAs and estate attorneys mean well, but they lack the training to create real asset protection structures.

❌ Your CPA’s job is tax efficiency—not lawsuit protection.

❌ Your estate attorney’s job is inheritance—not shielding assets from creditors.

✅ Our job is making sure your wealth stays protected—no matter what happens.

Don’t leave your assets exposed. Get a real asset protection strategy today.

👉 Call us now: (888) 773-9399

By: Brian T. Bradley, Esq.