Why Texas Trusts Don’t Work the Way You Think: Understanding Texas Asset Protection Laws

Texas is often perceived as a strong asset protection state, but many high-net-worth individuals, business owners, doctors, and real estate investors misunderstand how Texas asset protection trusts actually work.

While Texas does provide a robust homestead exemption, it does not recognize self-settled spendthrift trusts—a key factor that sets it apart from asset protection-friendly states like Nevada, South Dakota, and Delaware.

This means that:

✅ Revocable living trusts in Texas provide ZERO creditor protection.

✅ Texas irrevocable trusts are used for estate planning—not lawsuit protection.

✅ Investment properties, rental homes, business assets, stocks, and savings remain exposed.

For those who want true asset protection in Texas, traditional trusts are not the answer. Instead, advanced strategies like the Bridge Trust® provide a legally compliant and effective way to protect wealth from lawsuits, creditors, and legal threats.

Texas Revocable Living Trusts Offer No Asset Protection

One of the biggest misconceptions about Texas asset protection is that a revocable living trust (RLT) can shield assets from lawsuits. This is completely false.

A revocable living trust in Texas is:

✔ An estate planning tool, not an asset protection strategy.

✔ Designed to avoid probate—not to protect assets from creditors.

✔ Fully revocable—meaning a court can force the grantor to dissolve it.

💡 Important:

✅ If you can access the assets, so can your creditors.

✅ If you can revoke the trust, so can a court order.

A Texas revocable trust does not provide lawsuit protection and will not shield assets in cases of business liability, personal lawsuits, bankruptcy, or divorce settlements.

Texas Does Not Recognize Self-Settled Spendthrift Trusts

Unlike 21 asset protection states, Texas does not allow self-settled spendthrift trusts (also known as Domestic Asset Protection Trusts, or DAPTs).

What This Means for Texas Business Owners & Real Estate Investors

🚫 You cannot create a Texas asset protection trust for your own benefit.

🚫 If you set up a trust and remain a beneficiary, Texas courts will not recognize its protections.

🚫 A court can force you to distribute assets from the trust to satisfy creditors.

📌 Case Law Example:

In In re Blount (2010), U.S. Bankruptcy Court, the court ruled that a trust created for the settlor’s own benefit could not be used to shield assets from creditors.

This makes Texas less favorable for asset protection than states like Nevada, South Dakota, and Wyoming, which allow self-settled trusts that protect assets from creditors.

How Texas Uses Irrevocable Trusts (And Why They Don’t Provide Asset Protection)

Texas does allow irrevocable trusts, but they serve a completely different function than asset protection. These trusts are used primarily for:

✔ Wealth preservation for children, heirs, and future generations.

✔ Reducing estate tax liability.

✔ Structuring inheritances to prevent financial mismanagement by beneficiaries.

Disadvantages of Irrevocable Trusts for Asset Protection in Texas

🚫 Loss of control: Once assets are transferred, the grantor no longer owns or controls them.

🚫 Limited flexibility: If financial situations change, assets in the trust cannot be accessed or moved.

🚫 No protection for the grantor: Irrevocable trusts only protect assets for beneficiaries—not for the person who created the trust.

💡 If your goal is creditor protection while maintaining control of your wealth, a Texas irrevocable trust will not work.

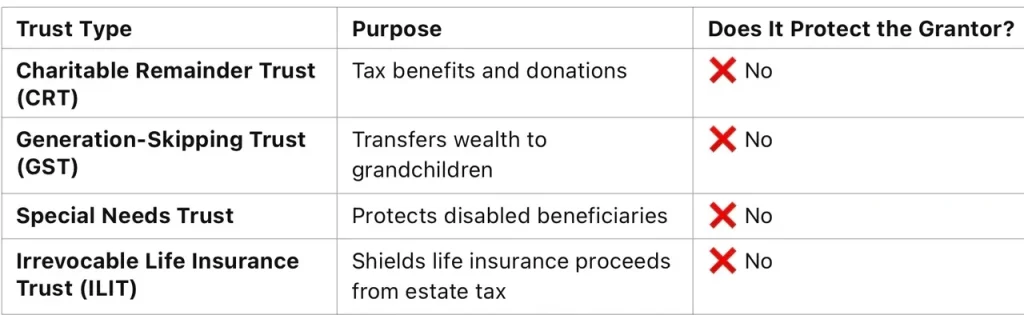

Common Irrevocable Trusts in Texas (And Their Purpose)

🔹 Conclusion: Texas irrevocable trusts are useful for estate planning, but they do not provide real-time asset protection.

The Bridge Trust®: The Best Asset Protection Strategy for Texans

For high-net-worth individuals, business owners, doctors, and real estate investors in Texas who need true asset protection while maintaining control, the Bridge Trust® is the best solution.

✔ IRS-compliant under IRC § 671-677.

✔ Combines domestic trust benefits with offshore protection.

✔ Structured as a domestic trust but can transition offshore when needed.

✔ Allows full control while shielding assets from lawsuits.

How the Bridge Trust® Works

1️⃣ Established as a U.S. Grantor Trust – It operates like a domestic trust, ensuring IRS compliance.

2️⃣ Pre-Positioned Offshore – Legally registered in the Cook Islands, the strongest asset protection jurisdiction.

3️⃣ Moves Offshore If Needed – In case of lawsuits, judgments, or major financial threats, the trust can transition offshore, where U.S. courts have no jurisdiction.

4️⃣ Avoids Fraudulent Transfer Risks – Since the trust exists before legal threats arise, it prevents accusations of fraudulent conveyance.

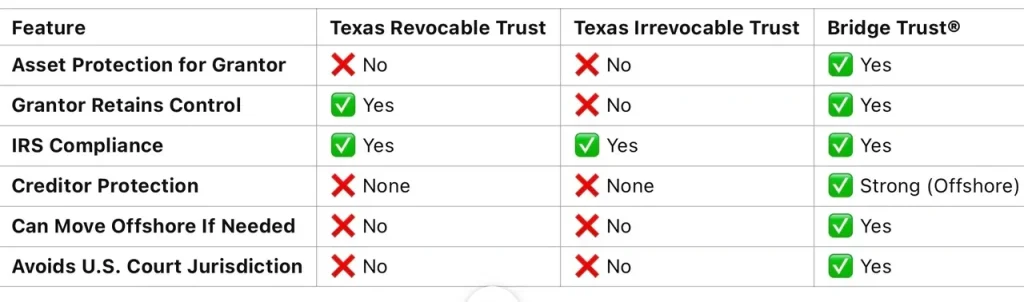

Comparing Texas Trusts vs. The Bridge Trust®

Final Takeaway: Why Texans Need More Than Just a Trust for Asset Protection

✔ Texas revocable living trusts do NOT protect assets from lawsuits.

✔ Texas irrevocable trusts are estate planning tools, NOT asset protection solutions.

✔ Texas does NOT allow self-settled spendthrift trusts (DAPTs).

✔ If you want to protect your wealth while keeping control, you need the Bridge Trust®.

For business owners, real estate investors, doctors, and high-net-worth professionals, the Bridge Trust® offers the strongest legal asset protection available while remaining fully compliant with Texas and federal laws.

📌 Want to protect your assets? Contact us today for a legal consultation! (888) 773-9399

By: Brian T. Bradley, Esq.